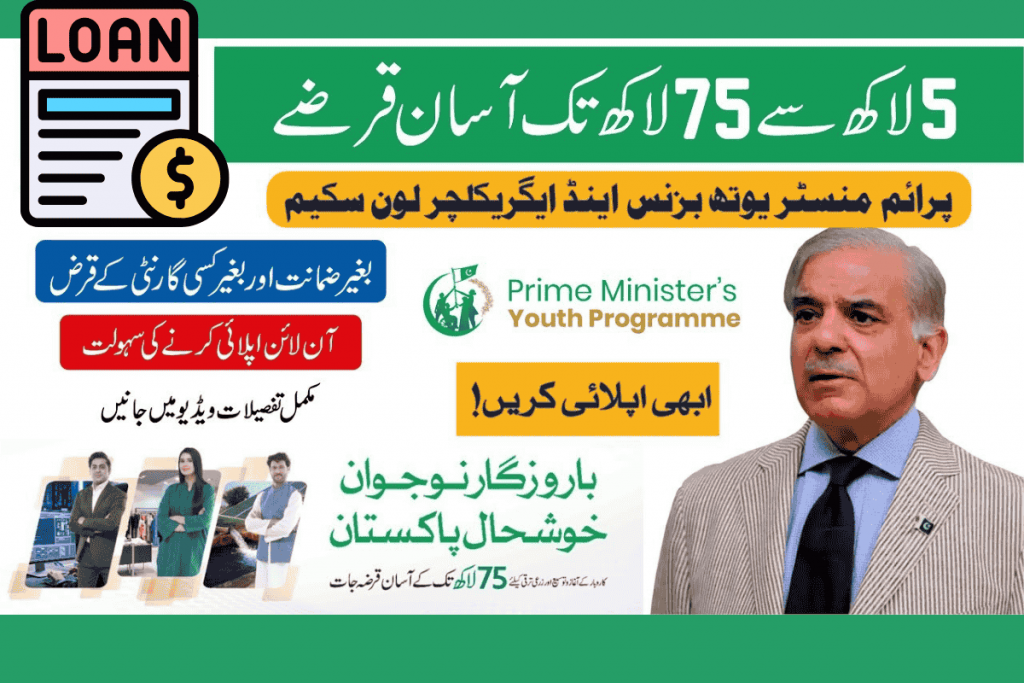

The Prime Minister Youth Business & Agriculture Loan Scheme is a government initiative aimed at empowering young people in Pakistan to start their own businesses or invest in agriculture. This loan scheme provides financial support for youth entrepreneurship and aims to boost economic growth by encouraging self-employment in both the business and agricultural sectors. If you’re a young individual looking to start a business or improve your farming operations, this scheme could be the perfect opportunity.

What is the Prime Minister Youth Business & Agriculture Loan Scheme?

The Prime Minister Youth Business & Agriculture Loan Scheme is a government-backed program designed to assist young Pakistanis with financial support to start or expand businesses or improve agricultural practices. The loan is specifically for youth entrepreneurs and farmers, offering affordable interest rates and flexible repayment plans. This initiative is part of Pakistan’s broader vision to create job opportunities, reduce unemployment, and promote economic growth through youth-led businesses.

Key Features of the Loan Scheme

- Low-Interest Loans for Youth Entrepreneurs: The Prime Minister Youth Loan Scheme offers loans at very low-interest rates, making it an attractive option for young people who may struggle to access traditional bank loans due to high-interest rates or lack of collateral.

- Flexible Repayment Terms: The repayment schedule for the loans is designed to be flexible. This means that young entrepreneurs and farmers can repay the loan over an extended period, ensuring they don’t face a financial burden while growing their businesses or agricultural ventures.

- Financial Support Across Various Sectors: This scheme is not limited to a specific sector; it provides loans to businesses in industries such as retail, manufacturing, agriculture, and service-based businesses. Young people from diverse backgrounds and industries can benefit from this scheme.

- Loan Amounts Tailored to Business and Agricultural Needs: Depending on the nature of the business or farm, the loan amounts can range from a few hundred thousand rupees to several million. This makes it suitable for both small startups and larger agricultural projects.

- Support for Start-ups and Farmers: The scheme is designed to assist young individuals who are interested in starting businesses or improving farming practices. Loans can be used to purchase equipment, machinery, seeds, livestock, or hire employees to help grow the business or farm.

Why is the Loan Scheme Important?

Pakistan’s youth population is one of the largest in the world, but many young people struggle to find jobs due to limited opportunities. The Prime Minister Youth Loan Scheme addresses this issue by promoting youth entrepreneurship and providing them with the financial resources needed to create their own jobs.

By offering affordable loans, the scheme enables young people to take charge of their futures, contribute to the economy, and support the development of the agricultural and business sectors. This initiative helps reduce youth unemployment and fosters a culture of self-reliance and innovation.

Eligibility Criteria for the Prime Minister Youth Loan Scheme

To apply for the Prime Minister Youth Business & Agriculture Loan, applicants must meet the following eligibility criteria:

- Age Requirement: Applicants must be between 21 and 45 years of age. This ensures that the scheme supports young individuals who are at an ideal stage to start a new business or improve agricultural productivity.

- Pakistani Citizenship: The applicant must be a Pakistani citizen. The scheme is designed to support youth within the country, helping them contribute to national development.

- Business or Agricultural Plan: Applicants must submit a well-detailed business or agricultural plan. This plan should clearly demonstrate how the loan will be used and how it will contribute to the success of the business or farm.

- No Previous Loan Defaults: To ensure financial responsibility, applicants must not have any previous defaults on loans.

- Skills or Experience: While prior experience in business or agriculture is not mandatory, applicants with skills in these areas will have a better chance of getting approval. The government may also offer training programs to applicants to help them develop the necessary skills for managing their business or farm.

Types of Loans Available

- Business Loans for Entrepreneurs: These loans are aimed at young individuals who wish to start or expand their businesses. The loan can be used for buying machinery, inventory, hiring employees, or renting business space. These loans are an excellent option for anyone looking to venture into small business opportunities in Pakistan.

- Agricultural Loans for Farmers: Agricultural loans are available to support young farmers. The loans can be used for purchasing modern farming equipment, seeds, fertilizers, livestock, and other resources necessary for improving productivity. These loans help farmers improve their income and agricultural practices, making them more sustainable.

- Micro Loans for Small Businesses: For smaller-scale businesses or micro-enterprises, the scheme also offers micro loans. These are smaller loan amounts designed to help individuals start small businesses, such as retail shops or service-oriented businesses, especially in rural or underdeveloped areas.

Benefits of the Prime Minister Youth Business & Agriculture Loan Scheme

The Prime Minister Youth Loan Scheme offers several significant benefits for youth entrepreneurs and the broader economy of Pakistan:

- Job Creation: By providing loans to start businesses, the scheme helps create job opportunities for young people. As businesses grow, they hire employees, leading to reduced youth unemployment in the country.

- Economic Growth and Development: Supporting young entrepreneurs and farmers helps boost the overall economy. Small businesses create wealth and contribute to the growth of various sectors, including agriculture, services, and manufacturing.

- Boost to the Agriculture Sector: Pakistan’s agriculture sector is vital to the country’s economy, and this scheme helps farmers adopt modern techniques to increase productivity, improve crops, and reduce costs. By increasing efficiency, young farmers can significantly impact food production in the country.

- Empowerment of Youth: This loan scheme empowers young people to take charge of their future. It provides them with the financial support needed to become self-reliant, whether in business or farming. Youth empowerment through financial support is one of the most important goals of this initiative.

- Encouragement of Innovation and New Ideas: Entrepreneurs bring fresh ideas and innovation to the market. This scheme encourages young individuals to think creatively, introducing new products and services that can benefit their communities and the economy.

How to Apply for the Loan?

Applying for the Prime Minister Youth Business & Agriculture Loan Scheme is simple and straightforward. Here’s how you can apply:

- Visit the Official Website or Participating Banks: You can apply online through the official website or visit designated banks that offer the loan scheme. The application process is user-friendly and can be completed online or in-person.

- Submit the Application Form: Fill out the application form with your personal details, business or agricultural plan, and financial information. The application form requires basic information about your proposed project and how the loan will be used.

- Provide Supporting Documents: You will need to submit documents such as your CNIC, proof of address, business or agricultural plan, and other relevant documents required by the bank.

- Loan Processing and Approval: After submitting your application, the bank or relevant authorities will review your documents and loan application. If everything is in order, the loan will be approved, and funds will be disbursed.

SMEDA Services

Small and Medium Enterprises Development Authority (SMEDA) has been tasked by PM’s Youth Programme Program with an advisory & supporting role to provide free guidelines to applicants.SMEDA Free Online Support

Punjab (Head Office)

- 4th Floor, 3rd Building, Aiwan-e-Iqbal Complex Egerton Road, Lahore

- Tel: (042) 111-111-456, 99204701-12

Baluchistan

- Bungalow No. 15-A, Chaman Housing Scheme Airport Road, Quetta

- Tel: (081)-2831623 – 2831702

- Email: helpdesk.balochistan@smeda.org.pk

Khyber Pakhtunkhwa

- Ground Floor, State life Building The Mall, Peshawar

- Tel: (091)-111-111-456, 091-9213046-7 Email: helpdesk.KhyberPakhtunkhwa@smeda.org.pk

Sindh

- 5th Floor, Bahria Complex II M.T. Khan Road, Karachi

- Tel: (021)-111-111-456

- Email: helpdesk.sindh@smeda.org.pk

We are very thankful to the Chief Minister of Punjab Alhamdulillah he is cooperating with us farmers a lot and we are very thankful to him for this initiative he has taken for the young generation.

Thank you very much Prime Minister Maryam Nawaz Sahib Thank you very much Alhamdulillah for the work you have done for the young generation.

I am a pharmaceutical related employee but I don’t have enough investment, I request the Chief Minister, Mr. Maryam Nawaz, that I am entitled to this loan and inshAllah, I have a good business mind and I want to start my own business. Please kindly select me in this matter thank you

Great opportunity for youth